CASE STUDY

Machine Learning Data Modeling & Forecasting for Foreign Exchange Risk Exposure

Executive Summary

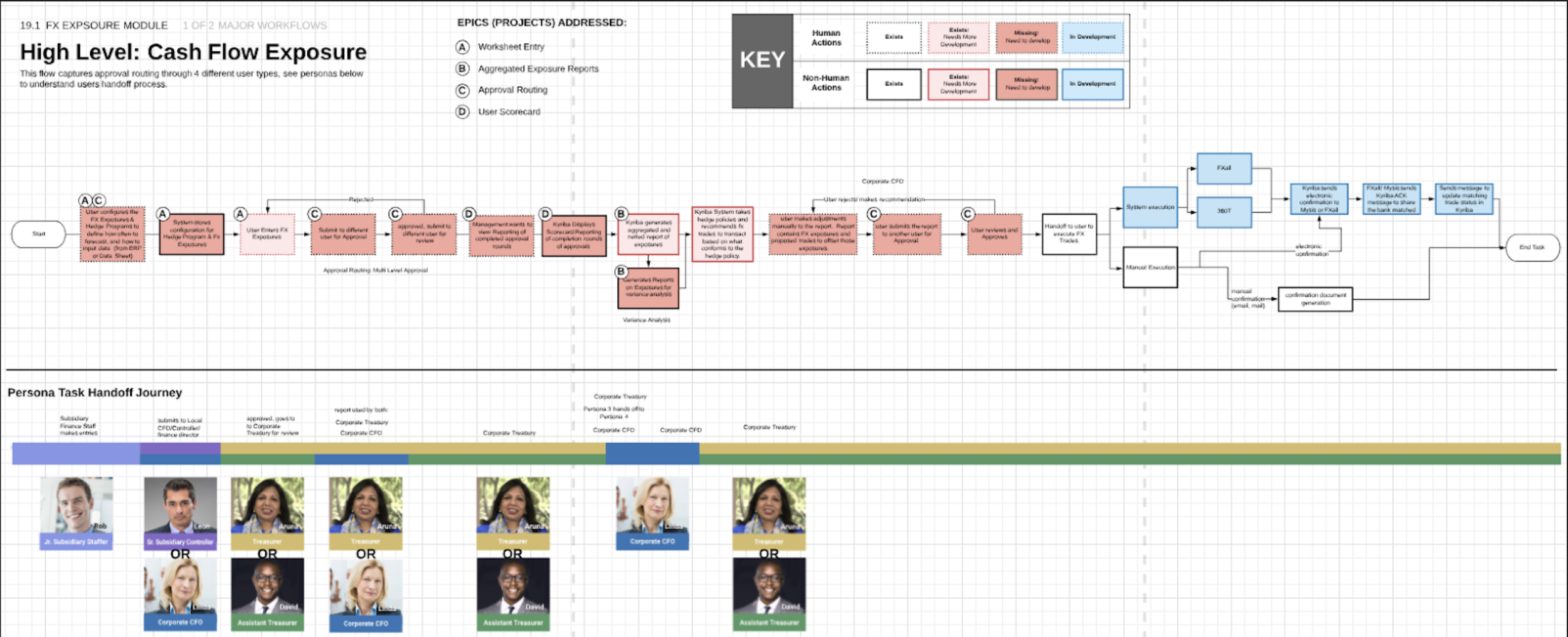

When working as a Principal Product Design Consultant at Kyriba, I led the end-to-end redesign of the FX Exposure capability—transforming it from a basic data-store into an intelligent, ML-driven forecasting and approval workflow. By centralizing historical and projected data, embedding variance tolerance alerts, and automating multi-level approvals, we reduced forecasting cycles from months to days and drove widespread feature adoption. This project earned CEO endorsement, accelerated treasury decision-making, and was a key differentiator in Kyriba’s acquisition.

Project Context

Company / Product

Kyriba is a leading cloud-based treasury and finance management platform. I worked on the FX Exposure capability, which identifies and manages foreign-exchange risk.Timeline & Team

This project started in 2019 and ran for 6-months.

Cross-functional team of ~20: product managers, business-development managers, engineers (front-end, back-end, DevOps, QA), data scientists, & sales engineers.My Role

Principal Product Designer embedded in the R&D mission team. Responsibilities spanned UX research, ML/AI product strategy, prototyping, hi-fi design, and stakeholder alignment (3 PMs, 2 BD leaders, Sales Director, CEO, CTO, & VP of Engineering).

Problem & Goals

Business Problem

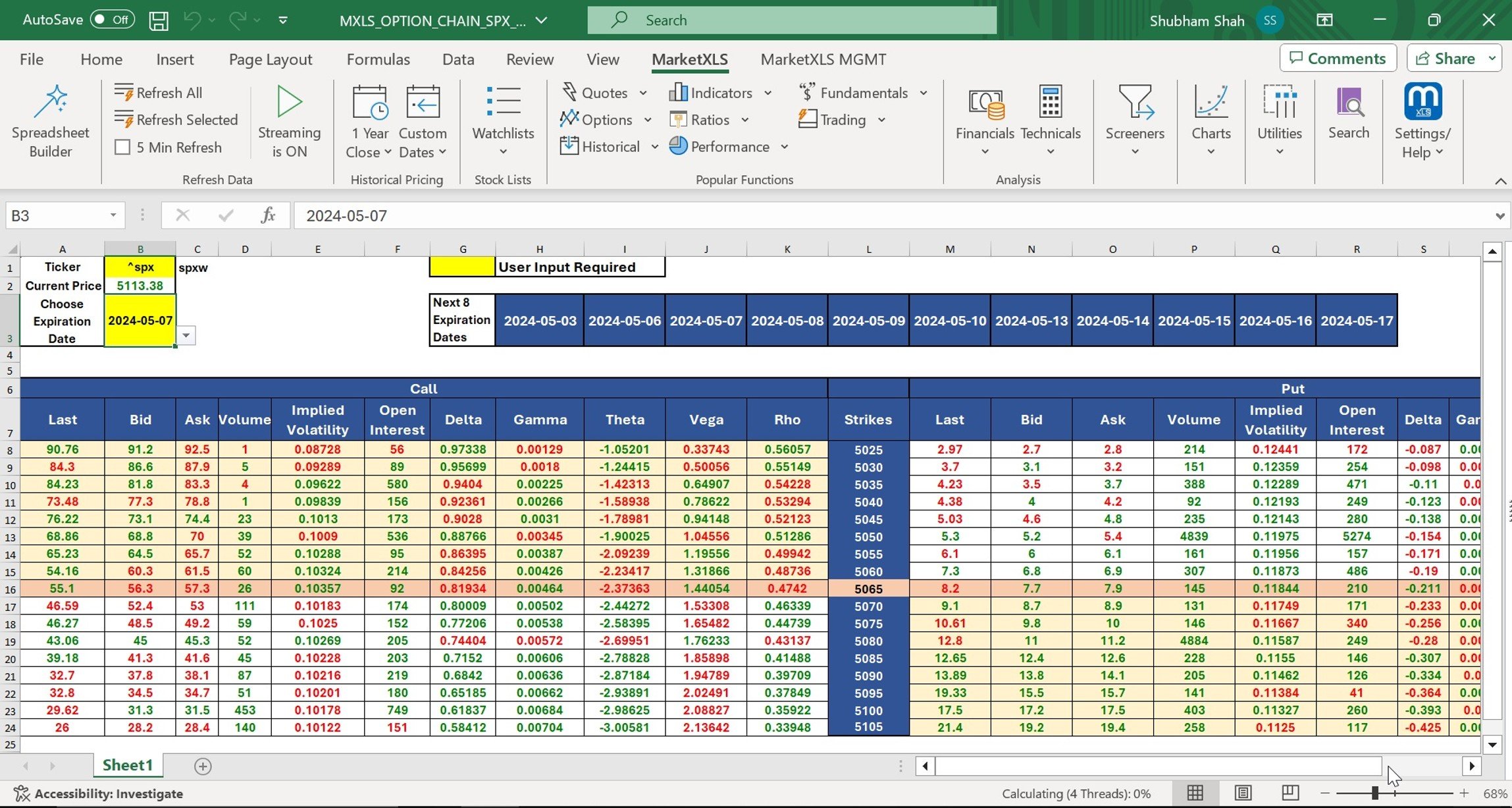

Existing FX Exposure feature had 35% adoption; analysts defaulted to Excel because the in-app worksheet only stored numbers and required manual approval outside of the platform.User Problem

Financial analysts juggled ≥5 tools and windows to model exposures, manually emailed spreadsheets for sign-off, leading to errors, delays, and poor visibility.Success Metrics

Adoption → majority of treasury team within two quarters

Forecast cycle time ↓ from 3-4 months to 1 month

Manual‐entry errors ↓ significantly

Stakeholder satisfaction ↑ (CFO endorsement)

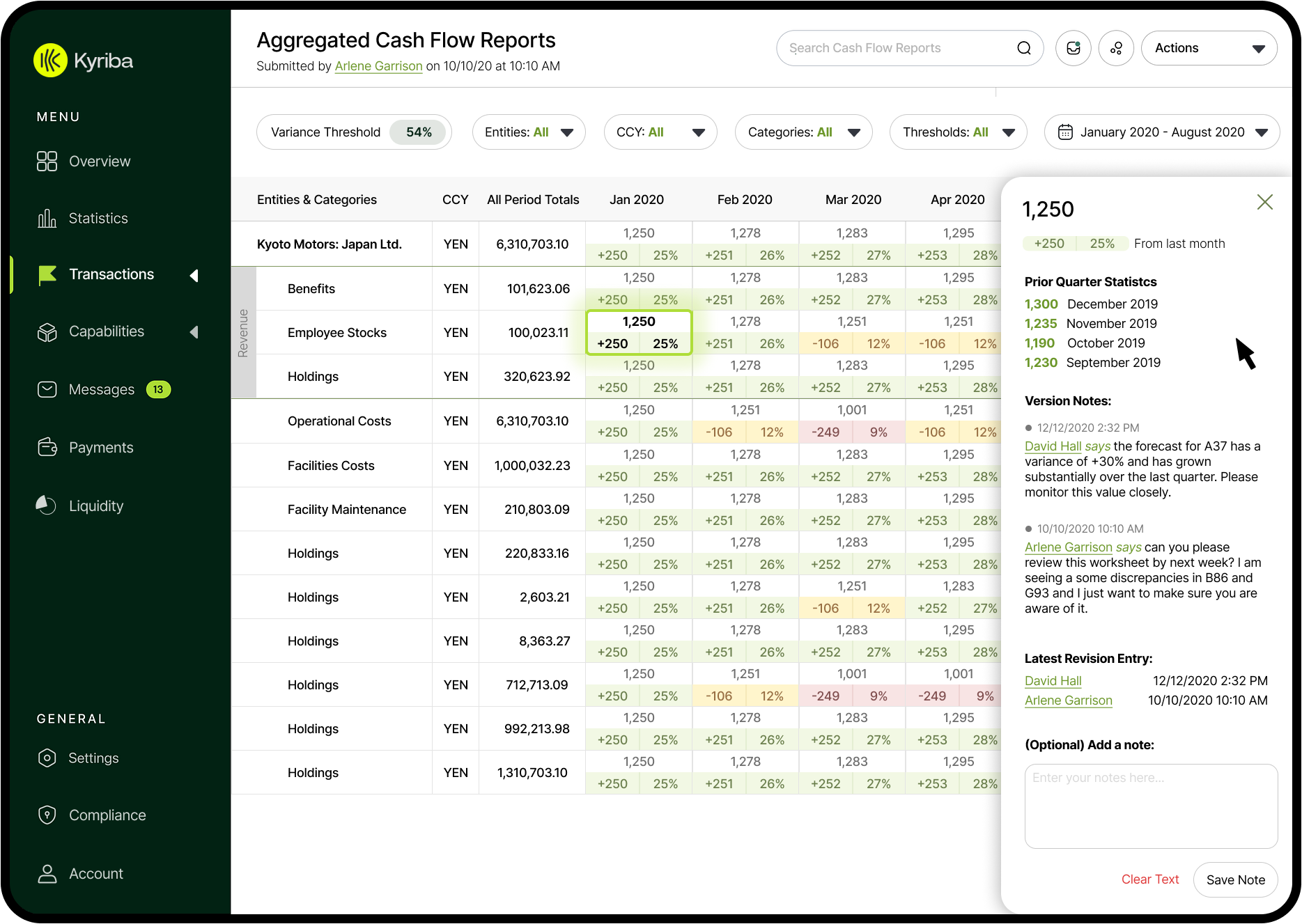

Existing Kyriba FX Cash Position Worksheet

An example of a user using Excel to model FX Data externally

Users & Research

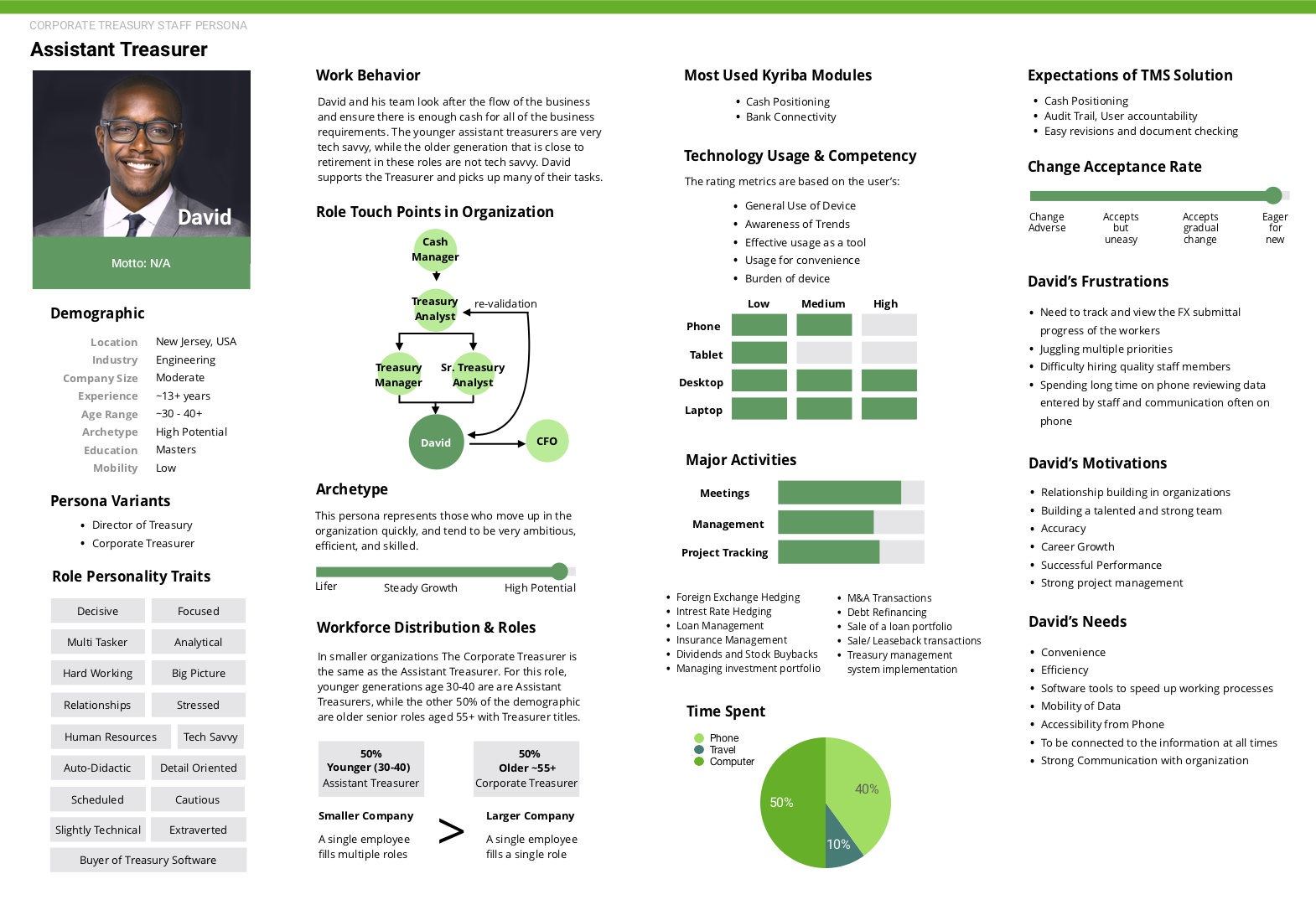

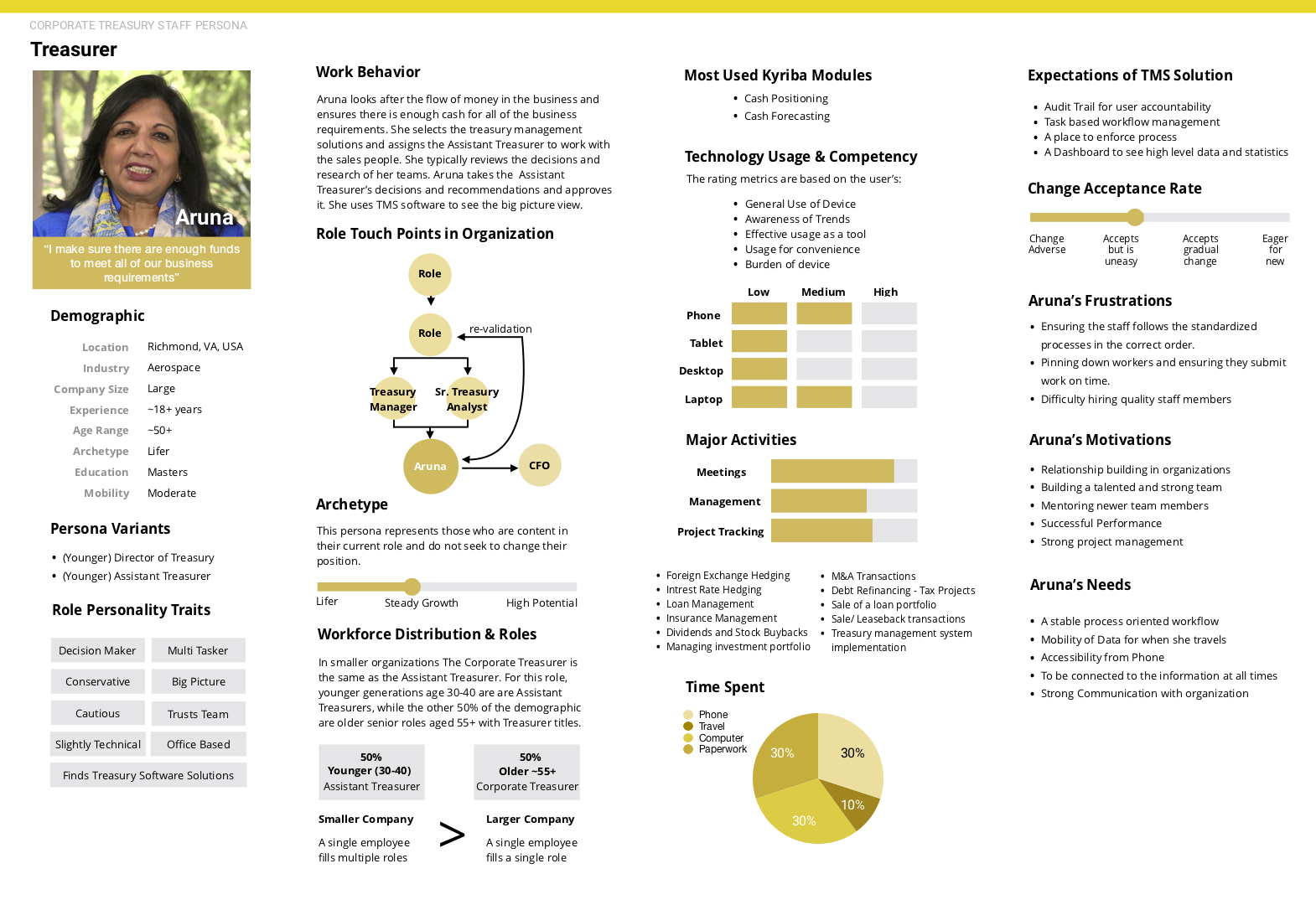

User Profiles / Personas

Financial Analyst – Builds exposure models; needs accuracy and speed.

Treasury Manager – Reviews forecasts; needs consolidated dashboards and governance.

CFO – Monitors net exposure; needs audit trails and strategic insights.

Methods & Key Insights

Onsite follow-me-home visits with 35 customers revealed 5+ open spreadsheets/windows per task.

Pendo, Heap, & Qliksense analytics showed a sharp drop-off at the manual approval step.

Primary insight: a centralized workflow engine and intelligent forecasting would eliminate context-switching and manual hand-offs.

Design Process

Ideation & Sketches

Facilitated workshops with PMs, BD, and sales to define ML forecasting scope and approval-flow requirements.Wireframes & Low-Fi Prototypes

Rapid mid-week sprints in Sketch → InVision; feedback loops with 3 PMs, 2 BD leads, and Director of Sales.Iterations & Trade-Offs

Balanced full-featured algorithm controls vs. cognitive load; opted for a simplified “variance tolerance” slider.

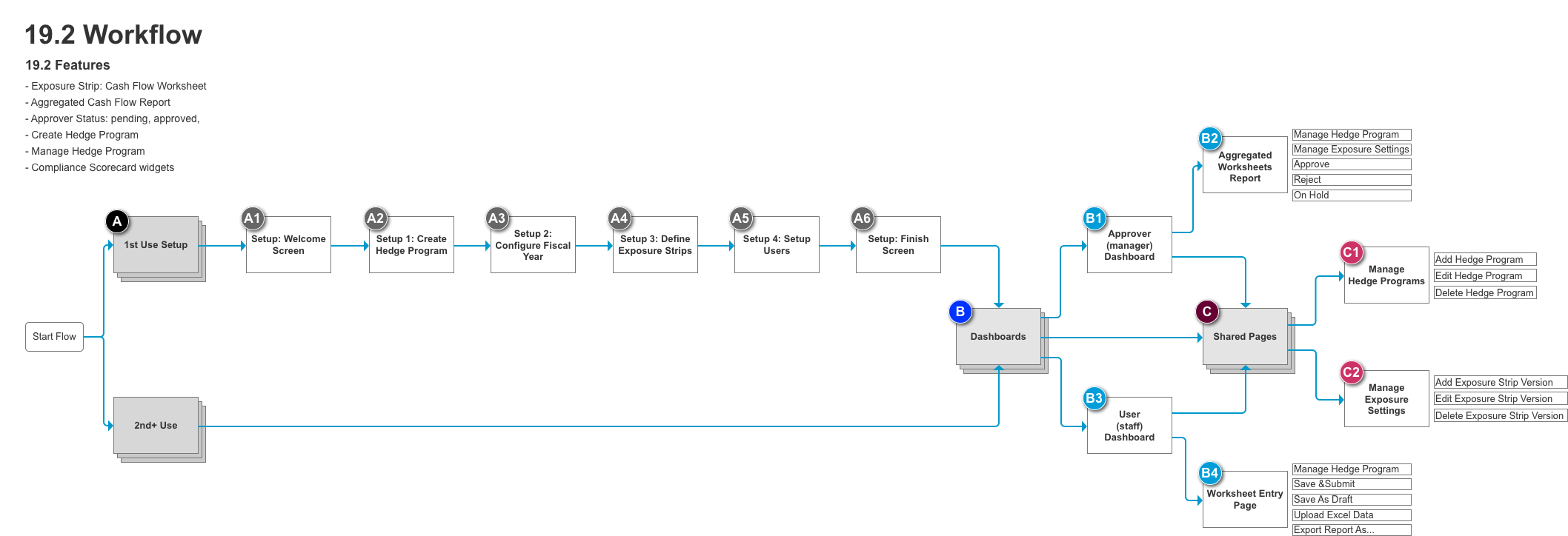

End to End Proposed Sitemap

Onboarding Experience Wireframe

Subsidiary Staffer Workspace

Treasury Analyst Workspace

Solution & Design

High-Fi Mockups

Data-modeling worksheet with integrated historical/projection panels

Variance alerts dashboard highlighting out-of-tolerance forecasts

Surface hedge recommendations based on real-time FX analytics

Automated approval workflow UI for analyst → manager → CFO

Role-based views and permissions

Interaction Highlights

Real-time variance coloring, one-click approve/reject, drill-down to historical drivers.

Outcome & Metrics

Quantitative Results

Forecasting cycle time shrank from ~3.5 months to <1.5 weeks

Feature adoption rose from <35% to ~83% of target users in Q1 post-launch

Qualitative Feedback

“Finally, one platform—I can see all the historical forecasting data in one place and this cuts my analysis work down almost completely. This trend insight is incredibly helpful and reduces my calls to my treasury manager for their opinions…”

– Senior Treasury Analyst, Customer“The forecasting review and approval process used to take us months of meetings and refinements, your new features have helped us to cut down on meetings and has saved us so much time because we can now easily do the review process through your platform…”

– Chief Financial Officer, Customer“This is a game-changer for our platform.”

– Jean-Luc Robert, CEO of Kyriba

Reflection & Next Steps

What Went Well

Rapid alignment across Product, Engineering, and Executive Leadership

Quick ML concept validation via BI-tool proof-of-concept

What I’d Do Differently

Conduct A/B tests on algorithm-threshold settings

Integrate accessibility audits earlier

Thanks for Reading

Check out other case studies below or visit the Case Studies page.